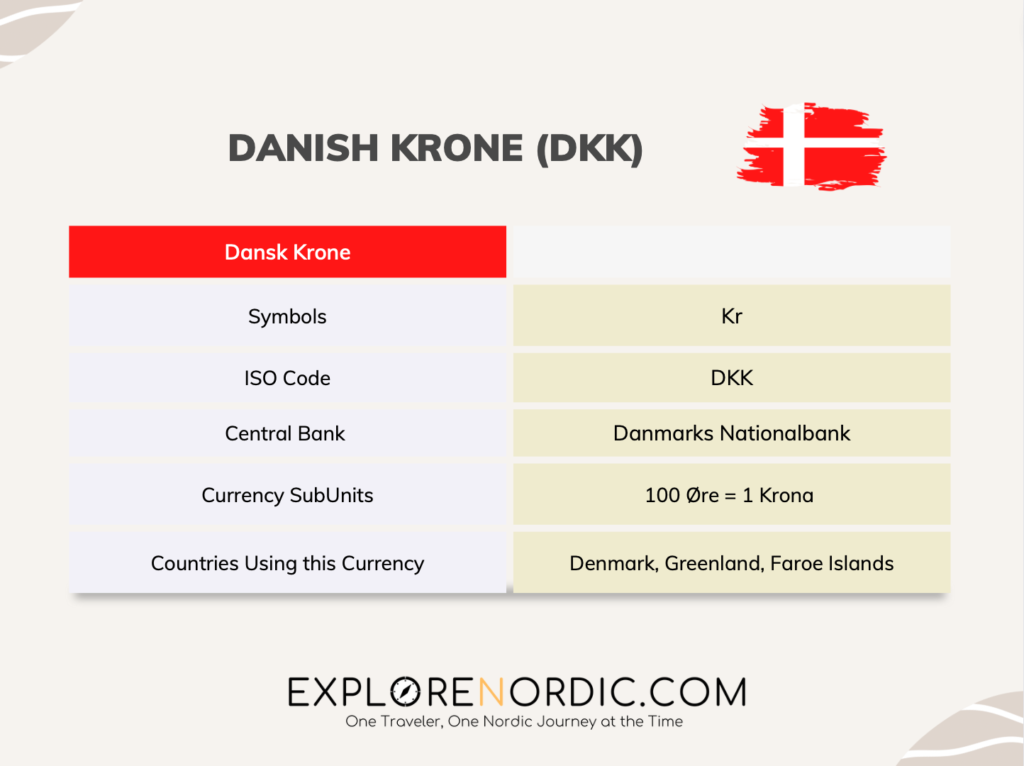

The official currency of Denmark is the Danish krone (DKK). It is divided into 100 øre. The symbol for the krone is “kr” and the symbol for the øre is “øre.” Coins come in denominations of 50 øre, 1 kr, 2 kr, 5 kr, and 10 kr. Banknotes come in denominations of 50 kr, 100 kr, 200 kr, 500 kr and 1000 kr. The answer to the question What is the Currency in Denmark? Is Danish Krone.

The Danish Central Bank manages the country’s monetary policy and issues the Danish krone. The krone is pegged to the euro, which means that its value is closely tied to the value of the euro. The exchange rate between the two currencies is roughly 7.5 kroner to 1 euro.

It’s important to note that Denmark is part of the European Union, but it has opted out of the Eurozone. This means that it doesn’t use the Euro as its official currency and the krone is not replace by Euro.

Credit Cards in Denmark

The major credit cards in Denmark are Dankort, Visa, Mastercard, and American Express.

Fun fact for international visitors: Dankort is the national debit card of Denmark and is widely accepted throughout the country. It is issued by most Danish banks and can be used for both online and offline purchases, as well as cash withdrawals.

Visa and Mastercard are also widely accepted in Denmark, and can be used in a similar way as Dankort. American Express is also accepted in some places, particularly in the larger cities and tourist areas.

When using credit and debit cards in Denmark, you may encounter a few different types of fees.

- Foreign transaction fees: Some credit card issuers charge a fee for transactions made in a foreign currency. This fee can range from 1-3% of the transaction amount.

- ATM withdrawal fees: Some banks charge a fee for using an ATM that is not part of their network. These fees can range from 20-50 DKK per transaction.

- Dynamic currency conversion (DCC) fees: Some merchants may offer to convert your purchase amount into your home currency. However, this service is often done at a higher exchange rate than the standard rate, and you may be charged a fee for this service.

- Interchange Fees: Some merchants may also charge a fee for card payments, this fee is to cover the cost of card acceptance.

That being said, credit and debit cards are widely accepted in Denmark and they are considered a convenient and secure way to pay. Always check with your bank or card issuer regarding any fees that may apply to your card before using it in Denmark.

Mobile Payment Apps

There are several local apps and digital payment methods that are commonly used in Denmark. The most common ones are;

- MobilePay: This is a popular mobile payment app in Denmark that allows users to transfer money and make payments using their smartphones. You can use MobilePay to pay for goods and services at participating merchants, and to transfer money to other MobilePay users.

- Swipp: This is another mobile payment app that allows users to make payments, transfer money, and pay bills using their smartphones. It is also widely used in Denmark.

Are there any restrictions on the amount of currency I can bring into Denmark?

There are no restrictions on the amount of foreign currency that you can bring into Denmark. However, if you are carrying more than 10,000 EUR or the equivalent in foreign currency, you are required to declare it to the Danish Customs and Tax Administration when entering the country. This is to prevent money laundering and the financing of terrorist activities.

Tipping in Denmark

Tipping is not a traditional practice in Denmark, as service charges are typically included in the prices of goods and services. This means that the prices that you see on menus and bills will already include a service charge. You don’t need to leave an additional tip. However, if you received exceptional service and you want to show your appreciation, it’s customary to leave a small tip, usually around 10-15%. This will also go for tours. Say that you do a full day tour in Copenhagen, and are extremely happy with the guide, then a small tip is appreciated but again not necessary.

Tipping in restaurants, cafes and bars is not expected, however if you do want to leave a tip, you can do it by rounding up the bill or leaving some small change.

Tipping taxi drivers is also not expected, but rounding up the fare to the nearest whole number is a common practice.

It’s important to note that in Denmark, service employees are paid a fair wage and do not rely on tips as a significant source of income as it is the case in other countries. Therefore, it is not seen as an obligation to tip and is considered a gesture of appreciation for good service.

It’s always a good idea to follow the lead of locals when in doubt. You can always ask your hotel staff or tour guide for guidance on local customs and etiquette regarding tipping.

Is Denmark a Cashless Society?

Denmark has been moving towards a cashless society in recent years, with many businesses and shops accepting card and digital payments instead of cash. However, cash is still widely accepted and used in Denmark, so it is not a completely cashless society yet.

There are several currency exchange offices in Denmark where you can exchange foreign currency for Danish kroner. These offices are typically found in major airports, tourist areas, and in the city centers. Some of the major currency exchange offices in Denmark include Forex Bank, Global Exchange, and X-Change. These currency exchange offices typically offer competitive exchange rates and charge a small fee for their services. You can also use your credit card or debit card to withdraw money from an ATM, which will also dispense Danish kroner.

Taxes to Be Aware of in Denmark

Taxes and additional charges that you should be aware of when making purchases in Denmark.

- Value-added tax (VAT): Denmark has a standard VAT rate of 25% which is included in the price of most goods and services. This tax is applied to most goods and services, except for some food items, books, and newspapers, which have a reduced VAT rate of 10%.

- Excise taxes: Some goods, such as tobacco products and alcoholic beverages, are subject to additional excise taxes. These taxes are included in the price of the goods and are collected by the Danish government.

- Environmental taxes: Some goods, such as cars and certain types of energy-efficient appliances, are subject to environmental taxes. These taxes are intended to encourage the use of environmentally friendly products and are included in the price of the goods.

- Customs duties: If you are importing goods into Denmark, you may be subject to customs duties. These duties are based on the value of the goods and the type of product.

It’s important to note that prices for goods and services in Denmark may be higher than in other countries due to these taxes. Keep in mind that these taxes are included in the price of most goods and services. They are not typically added on top at the point of purchase.

As a general rule, foreign visitors (from outside of the EU) can claim back the VAT (Value Added Tax) paid on purchases made in Denmark. They have to take the goods out of the country within three months of purchase. This is known as VAT refund. Make sure to check if you are eligible.

What is the Danish Currency? The History of the Danish Krona

The Danish krona (DKK) is the official currency of Denmark. The word “krona” is derived from the Latin word “crown,” as the Danish currency was originally based on the value of gold and silver coins called crowns.

The first Danish currency was the rigsdaler, which was introduced in the late 1700s. This currency was replaced by the krona in 1875, at which time it became pegged to the gold standard. The krona remained pegged to the gold standard until the outbreak of World War I, after which it was allowed to float on the foreign exchange market.

During the 1920s and 1930s, the krona experienced significant inflation, which led to its devaluation in the 1930s. In the post-war period, the krona was pegged to the US dollar. However, in the early 1970s, Denmark, along with other European countries, switched to floating exchange rates and pegged the krona to the European Currency Unit (ECU). This was the forerunner of the Euro.

Denmark is not part of the Eurozone, so the Danish krona remains the official currency of Denmark. The krona is issued and controlled by the Danish Central Bank, called Danmarks Nationalbank.

The Future, the Danish e-Krona?

Denmark has not yet introduced an e-krona, which is the digital version of its national currency. However, it has been exploring the possibility of issuing a central bank digital currency (CBDC) in the past. The Danmarks Nationalbank, the country’s central bank, has been conducting research and pilot projects on the potential benefits and risks of issuing an e-krona.

The central bank has said that a potential e-krona would provide a complement to physical cash, and would be aimed at ensuring that the public has continued access to a reliable and efficient means of payment. It also said that the e-krona would not be intended to replace cash, but rather to provide an alternative means of payment.

As of now, Denmark has not yet made any official announcement about issuing an e-krona and it’s still on research and development stage.

Relevant Reads:

- Scandinavian Hotels – Everything You Need to Know

- Top 10 Things to Do in Copenhagen

- Best Tours in Copenhagen