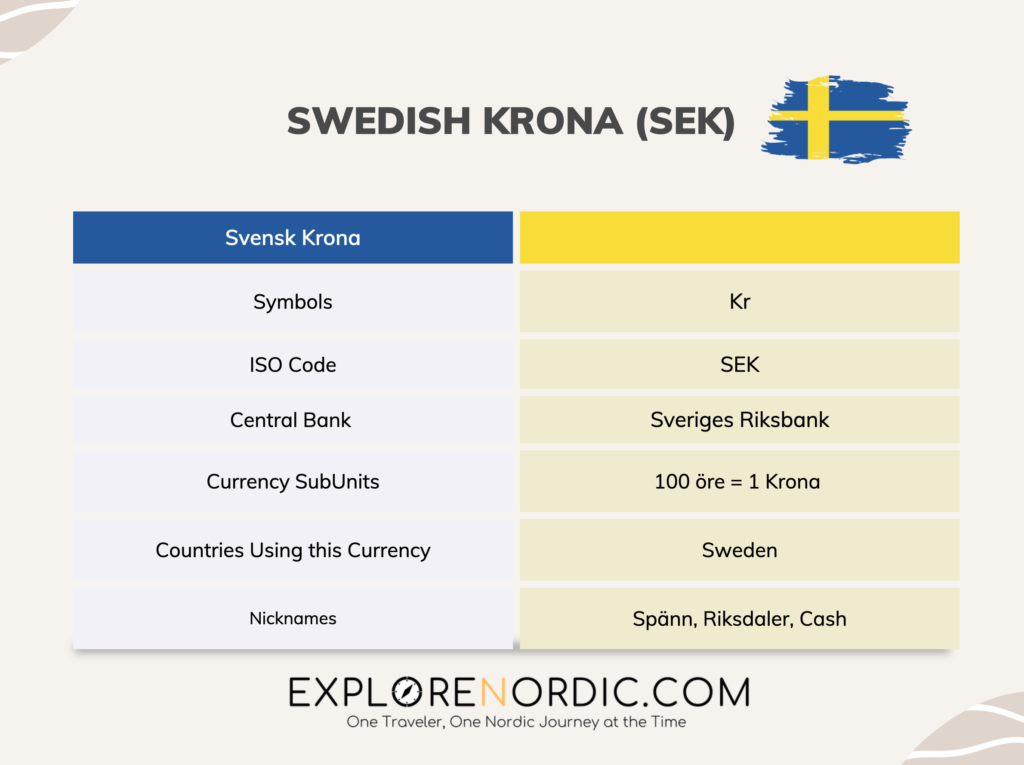

What is the Swedish Currency? Let’s dive into it. The Swedish krona (Svensk krona) is the currency used in Sweden. The ISO code SEK and currency sign “kr” are commonly used. 1 Swedish “kr” divides into 100 öre. Banknotes (paper money) come in denominations of 20, 50, 100, 200, 500, and 1,000 kronor, and coins come in denominations of 1, 2, 5, and 10 kronor. All öre coins were discontinued in 2010.

Sweden has not yet adopted the euro. So at most places it’s not possible to pay with euros or any other currency besides the krona in cash.

Major Credit Cards

However, major credit cards, such as Visa, MasterCard, and Maestro, are widely accepted throughout the country. In order to use a credit card to pay or withdraw cash, it must have a chip and a personal identification number (PIN).

Cashless Society

Sweden is known for being a cashless society. Most bank branches no longer handles cash and many shops and restaurants only accept plastic or mobile payments. It is possible to get cash from ATMs using these credit cards, although there may be a fee for the withdrawal.

Swedish Currency Exchange Offices

Currency exchange offices, such as Forex and Tavex, are also available for exchanging currency or cashing travelers’ cheques.

Swish Mobile App

Many Swedes use the mobile app Swish (similar to Venmo in the US) for banking and mobile payments. To use Swish it requires a Swedish bank account and social security number (person nummer).

Good to Know about Money Traveling to Sweden

Are there any restrictions on the amount of currency you can bring into Sweden?

There are no restrictions on the amount of foreign currency you can bring into Sweden. However, you are required to declare if you are carrying cash or other monetary instruments of a total value of more than EUR 10,000 when entering or leaving the country according Tullverket, the Swedish Custom Service.

This is to prevent money laundering and the financing of terrorist activities. The declaration must be made to the Swedish Customs Service and the police at the point of entry or exit. It’s important to be aware of the local laws and regulations when traveling to Sweden, and to carry your passport or ID card as you may be required to show it to customs officials.

Fees When Using Credit or Debit Cards

When using credit and debit cards in Sweden, you may encounter a few different types of fees:

- Foreign transaction fees: Some credit card issuers charge a fee for transactions made in a foreign currency. This fee can range from 1-3% of the transaction amount.

- ATM withdrawal fees: Some banks charge a fee for using an ATM that is not part of their network. These fees can range from SEK 20-50 (approx USD 2-5) per transaction.

- Dynamic currency conversion (DCC) fees: Some merchants may offer to convert your purchase amount into your home currency. However, this service is often done at a higher exchange rate than the standard rate, and you may be charged a fee for this service.

- Interchange Fees: Some merchants may also charge a fee for card payments, this fee is to cover the cost of card acceptance.

That being said, credit and debit cards are widely accepted in Sweden, it’s considered a convenient and secure way to pay.It’s recommended to check with your bank or card issuer regarding any fees that may apply to your card before using it in Sweden.

Taxes to Be Aware of in Sweden

There are some taxes and additional charges that you should be aware of when making purchases in Sweden.

- Value-added tax (VAT): Sweden has a standard VAT rate of 25% which is included in the price of most goods and services.

- Excise taxes: Some goods, such as tobacco products and alcoholic beverages, are subject to additional excise taxes. These taxes are included in the price of the goods and are collected by the Swedish government.

- Environmental taxes: Some goods, such as cars and certain types of energy-efficient appliances, are subject to environmental taxes. These taxes are intended to encourage the use of environmentally friendly products and are included in the price of the goods.

It’s important to note that prices for goods and services in Sweden may be higher than in other countries due to these taxes. Keep in mind that these taxes are included in the price of most goods and services and are not typically added on top at the point of purchase, but you should always double check with the merchant.

You might be eligible to get some of the VAT tax back depending on what country you are from and how much you spend.

Tipping in Sweden

Tipping is not a traditional practice in Sweden, as service charges are typically included in the prices of goods and services. This means that the prices you see on menus and bills will already include a service charge, and you don’t need to leave an additional tip. However, if you received exceptional service and you want to show your appreciation, it’s customary to leave a small tip, usually around 10-15%.

Tipping in restaurants, cafes and bars is not expected, however if you do want to leave a tip, you can do it by rounding up the bill or leaving some small change.

Tipping taxi drivers is also not expected, but rounding up the fare to the nearest whole number is a common practice.

It’s important to note that in Sweden, service employees are paid a fair wage and do not rely on tips as a significant source of income as it is the case in other countries. Therefore, it is not seen as an obligation to tip and is considered a gesture of appreciation for good service.

It’s always a good idea to follow the lead of locals when in doubt, and you can always ask your hotel staff or tour guide for guidance on local customs and etiquette regarding tipping.

What is the Swedish Currency? History of the Swedish Krona

The krona, the current currency of Sweden, was introduced as part of the Scandinavian Monetary Union, which was in effect from 1876 to the start of World War I. The union included Denmark, Norway, and Sweden. The “krona” was used in Sweden, while the “krone” was used in Denmark and Norway. The name “krona” and “krone” both mean “crown” in English.

The three currencies were pegged to the gold standard, with the krona being defined as 1/2480 of a kilogram of pure gold. During World War I, the convertibility of the three currencies to gold was suspended, and they were no longer mutually interchangeable. Despite being pegged to gold for most of the interwar period, these currencies were generally quoted at fluctuating market rates.

The Future, the Swedish e-Krona?

What is the Swedish Currency? Will it be the e-krona in the future? The e-krona, or electronic krona, is a proposed digital currency that would be issued directly by the Riksbank, the central bank of Sweden. Unlike electronic transfers using commercial bank money, the e-krona would be central bank money. These carries no nominal credit risk as it represents a claim on the central bank, which cannot go bankrupt.

The Riksbank has not yet made a decision on whether to issue the e-krona but is considering it as a potential complement to cash, rather than a replacement. The declining use of cash in Sweden has made the issue of an e-krona more pressing for the central bank, which has a statutory duty to continue issuing banknotes and coins as long as there is demand for them in society.

In December 2020, the Swedish government announced a review of the feasibility of moving to a digital currency. It was expected to be completed by the end of November 2022. The E-krona is currently (early 2023) in pilot phase 2, follow the progress at Riksbanken.

What’s your thoughts on the Swedish currency, the krona? Have you ever held a krona in your hand?

Good resources: